The Decentralised

- Aster has seen enormous growth in its perpetual volume in recent weeks.

- But detailed data in unavailable, making it impossible to rule out wash trading.

- DefiLlama delisted Aster perp volume over the weekend.

A version of this article appeared in our The Decentralised newsletter on October 7. Sign up here.

Decentralised exchanges offering perpetuals trading are taking the crypto industry by storm.

Hyperliquid has seen $2.8 trillion in perpetual trade volume since it launched about a year ago. More remarkable still, a competitor named Aster appeared to be closing the gap — in September, it overtook Hyperliquid in daily trading volume.

Or did it?

DefiLlama, a DL News sister company, delisted Aster’s perpetual volume over the weekend, citing its inability to verify whether there’s any wash trading on the platform.

“Aster is reporting very, very high perp volumes — to the tune of $100 billion,” 0xngmi, the pseudonymous head of DefiLlama, told me on Monday. “So it’s a bit suspicious.”

Typically, this isn’t a problem. Blockchains allow anyone with an internet connection to check and account for suspicious-seeming data.

Plenty of decentralised trading venues see some amount of wash trading, a form of market manipulation in which traders trade with themselves in order to create the false impression a particular token is taking off. That, in turn, can lure other traders who want to cash in on the false hype.

While the practice is frowned upon, crypto systems are open and verifiable, allowing data providers like DefiLlama to filter out phony trades.

0xngmi cited Hyperliquid, Arbitrum-based exchange GMX, and Solana-based exchange Raydium as venues that make it possible to check for such activity.

“In GMX’s case, it’s all Arbitrum. So you can just go to Arbiscan and see the transactions, or you can run an Arbitrum node and see the transactions,” 0xngmi said.

But DefiLlama can’t run an Aster node, as Aster doesn’t provide the requisite software, he added.

Aster didn’t immediately respond to a request for comment.

Perp DEXs allow traders to speculate on crypto price moves without expiry dates and with massive leverage.

Hyperliquid has dominated the sector this year, but a redesigned airdrop campaign launched Aster into first place last month.

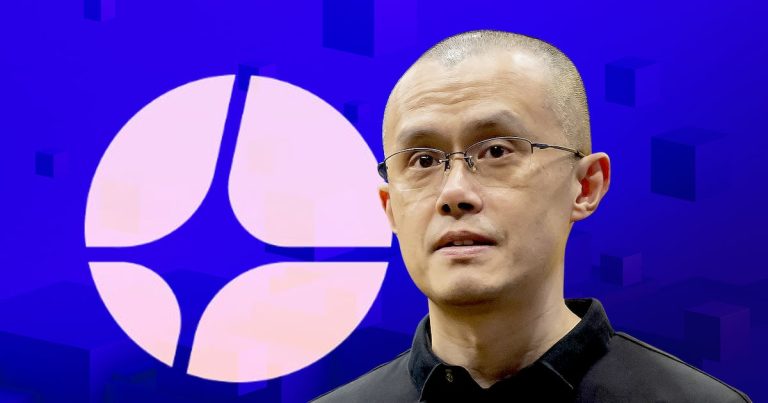

The upstart is backed by YZi Labs, a family office run by Changpeng Zhao, the former Binance CEO. Zhao has used his star power to hype up his investment in Aster.

YZi Labs didn’t immediately return a request for comment.

The exchange provides data via an API. But using that data is akin to taking Aster’s word for it, according to 0xngmi — a no-no in the crypto industry, where verification is the gold standard.

DefiLlama’s decision to delist Aster perpetual volume drew criticism and support. Supporters said they knew Aster’s volume was fake all along — a charge that goes too far, 0xngmi told me. While the enormous volume raises questions, proving it was a result of wash trading would require additional data that Aster has yet to provide.

“We don’t really have any data to back it up,” he said of the claim Aster’s perp volume was totally fake.

And then there were the critics, who were happy to take whatever numbers Aster provided.

“It is a point of view,” 0xngmi said. “But it makes DefiLlama way less useful than if it’s a bit more opinionated, you could say.”

Top DeFi stories of the week

This week in DeFi governance

VOTE: Morpho DAO votes to deploy MORPHO token on Hyperliquid

VOTE: GMX DAO votes to elect listing committee

PROPOSAL: Arbitrum DAO discussed new version of delegate incentive program

Post of the week

It’s crime szn. Why not resurrect the bankrupt crypto companies that set off the 2022 crypto winter? With a rebrand, of course.

Aleks Gilbert is DL News’ New York-based DeFi correspondent. You can reach him at aleks@dlnews.com.