Bitcoin (BTC) has traded mostly sideways this week, hovering near $121,300 after a mild 1% weekly rise. On the surface, the Bitcoin price move seems uneventful, but a closer look at key chart structures and investor behavior suggests that the next big breakout might need one more correction before it happens.

Some crucial indicators — both on the chart and on-chain — now point to a deeper pullback forming underneath the surface, even as a new long-term target takes shape.

Sponsored

Sponsored

Chart Patterns Hint at a Cooling Phase Before the Next Leg Up

Bitcoin’s current setup is shaping into a classic reversal structure that has historically preceded major rallies. The inverse head & shoulders pattern, still developing, shows the early signs of symmetry between its left and right halves — suggesting the market may be in the process of building a foundation for the next advance.

However, short-term traders are watching a developing slope pattern that’s rising slightly (forming a rising wedge-like structure), showing potential exhaustion near the top and more immediate bearishness.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, the Relative Strength Index (RSI), which measures market momentum, has started to diverge from price. Between July and early October, Bitcoin’s price made higher highs, while the RSI made lower highs — a bearish divergence that often signals fading buying strength.

This combination — a maturing chart pattern and a bearish wedge-like formation paired with weakening momentum — suggests that the Bitcoin price might first test lower levels to fully form its right side before attempting a breakout.

Sponsored

Sponsored

Whales and Long-Term Holders Add to the Selling Pressure

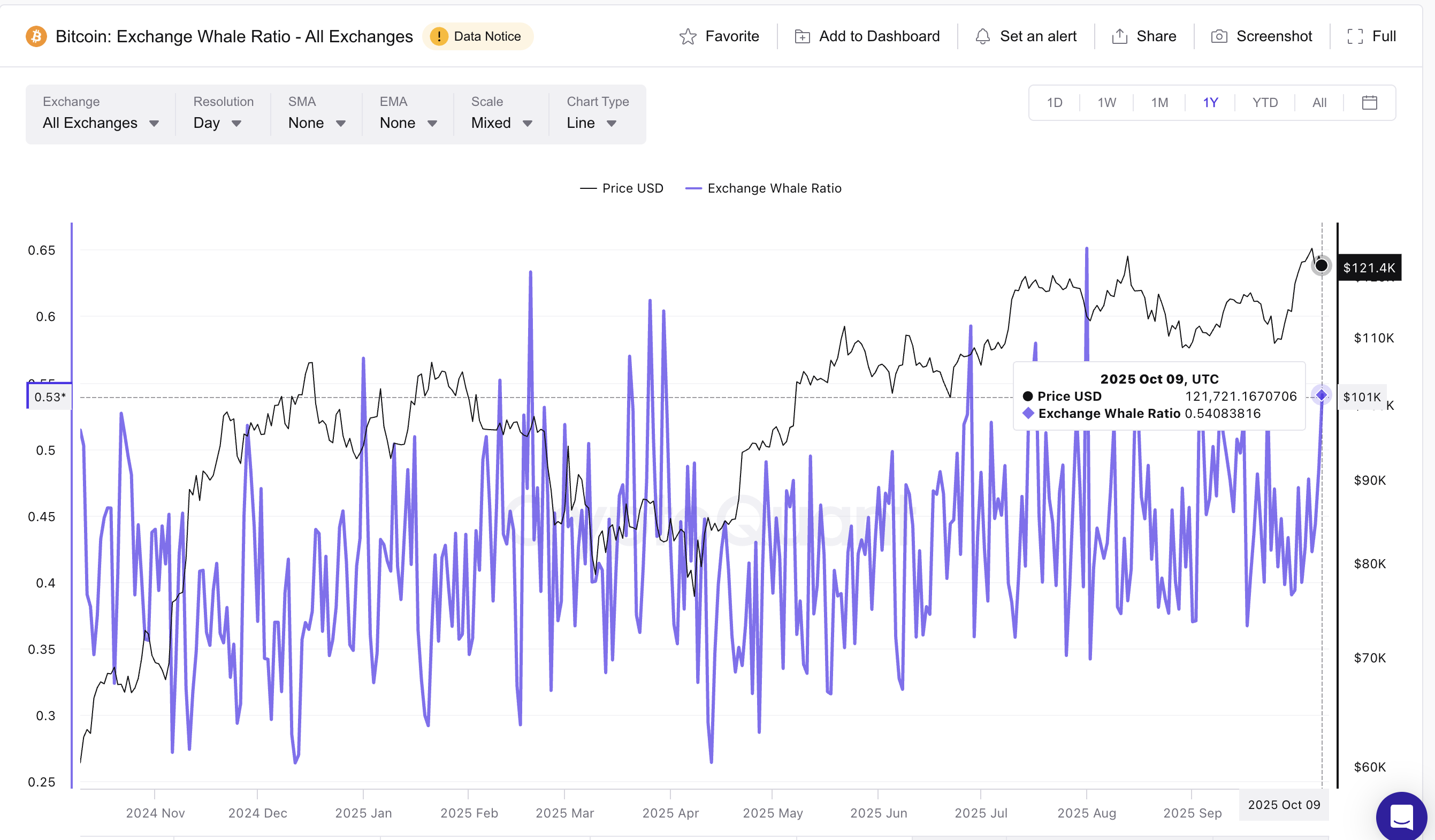

On-chain data backs the technical setup. The Exchange Whale Ratio, which measures the share of exchange inflows from the largest 10 addresses, has surged to 0.54 — its highest level since August 1. That signals increased whale deposits to exchanges, usually tied to short-term selling or portfolio rebalancing.

Meanwhile, long-term investors have turned net sellers. The Hodler Net Position Change, which tracks monthly accumulation or distribution, dropped sharply from +3,082 BTC on September 28 to –23,461 BTC on October 9. This swing of over 26,000 BTC shows clear profit-taking by veteran holders.

The combination of whale inflows and long-term selling suggests that big players expect near-term volatility before confidence returns — fitting the picture of a developing pattern rather than a completed one.

Key Bitcoin Price Levels to Watch

Bitcoin’s broader structure still targets around $147,700, based on the projection from its current setup. For that move to play out, the market must first stabilize and break cleanly above $126,100 (all-time high), close to the neckline level of the ongoing inverse head and shoulders pattern.

Until then, short-term support lies between $117,900, $114,700, and $111,800. Holding those zones keeps the structure intact. A fall below $107,200 would invalidate the bullish projection, while reclaiming $126,100 could trigger a move toward $147,700 — marking the start of Bitcoin’s next leg higher.

For now, the message is simple: a pullback might come before the push. The structure remains bullish, but patience will likely define who catches the next breakout. Just to reiterate, the Bitcoin price structure, based on this pattern, will continue to lean bullish unless BTC falls under $107,200.