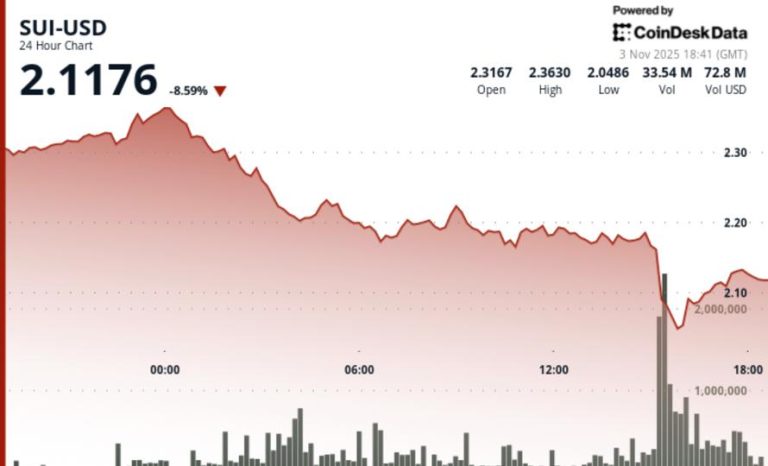

SUI, the native token of the Sui network, plunged 9% to $2.10 over the past 24 hours, sharply underperforming the broader crypto market during a sector-wide selloff.

The token’s 4.89% lag behind the crypto market suggests the move wasn’t just about market weakness but that it was SUI-specific.

The selloff carried the hallmarks of institutional liquidation. Prices dropped from $2.32 to test critical support, with trading volume surging 53% above the 7-day average. The spike in activity points to large-block repositioning, not a retail-driven panic.

At the core of the move was a decisive breakdown at $2.16. SUI dropped through that level on volume of 99.13 million tokens — 628% above its 24-hour average — confirming strong bearish pressure. That breakdown was followed by a sharp rebound from $2.04, forming a V-shaped bounce as institutions appeared to scoop up the token at lower levels.

Still, the recovery lost steam near $2.13, a psychological resistance zone. Volume declined into the close, suggesting buyers lacked conviction to push SUI meaningfully higher in the short term.

Elsewhere, the CoinDesk 5 Index (CD5) saw a 3.35% drop to $1,860.70, including a flash crash to $1,826.66 before bouncing back. The move also showed signs of institutional selling, overwhelming technical support in a high-volatility session.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.