In brief

- Official Trump (TRUMP) meme coin now trades above $4 with a $991 million market cap, making it the sixth-largest meme coin.

- The Trump family has generated over $1 billion in profits from crypto ventures, including TRUMP, World Liberty Financial, and the MELANIA token.

- Rep. Maxine Waters introduced the “Stop TRUMP in Crypto Act of 2025” to block the president and family members from owning crypto assets while in office.

It was a Friday night bombshell that nobody saw coming.

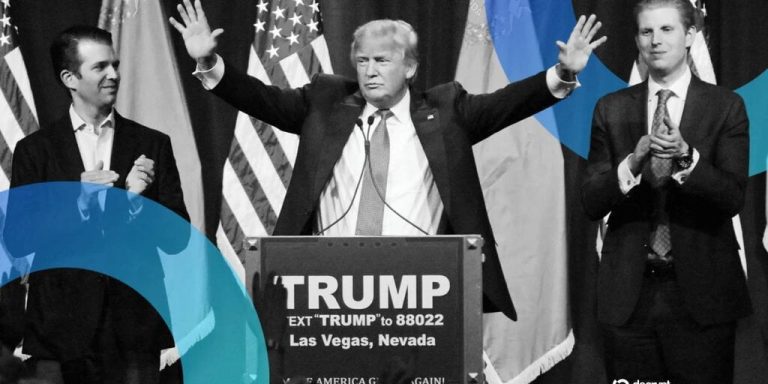

Three days before his second inauguration last January, President Donald Trump’s social media accounts lit up with news of the launch of Official Trump (TRUMP), a Solana-based meme coin bearing his name and political brand.

The token jumped to a $10 billion market cap within hours, reaching a peak of $73 and sending degen traders into a frenzy, triggering more than 8 million requests per minute that overwhelmed Phantom Wallet’s infrastructure.

A year on, and the TRUMP token is trading just below $5, down about 93% from its all-time high, with a market cap exceeding $987 million, according to CoinGecko data.

As TRUMP turns one, conflict-of-interest questions remain unresolved—the Trump family continues to run multiple crypto ventures while the President is in office, and Democrats increasingly cite his personal enrichment as a reason to block digital asset reform.

“Trump’s meme coin launch has done more harm than good to the industry as his political opponents are citing his personal gains from the meme coin launch as a reason to block or slow down the crypto’s legislative process,” Peter Chung, head of research at Singapore-based Presto Labs, told Decrypt. “It’s an unnecessary distraction.”

Trump’s crypto conflicts have dominated debate and even delayed the passage of the stablecoin GENIUS Act.

In May, Rep. Maxine Waters (D-CA) led a Democratic walkout over “Trump’s crypto corruption” in a bid to force divestment language into the bill.

Crypto connections

The president’s crypto connections stretch from the meme coin to World Liberty Financial and its USD1 stablecoin.

His family’s crypto empire has mushroomed to generate more than $1 billion in profits, according to his son, Eric Trump, who told the Financial Times in October that the figure was “probably more.”

Last May, Rep. Waters introduced the “Stop TRUMP in Crypto Act of 2025,” aimed at targeting the president’s ability to profit from digital assets while in office.

That same month, the president held a closed-door dinner for the top 220 TRUMP holders (press barred), including Tron founder Justin Sun, who bought over $22 million in TRUMP and invested tens of millions in World Liberty.

Senator Elizabeth Warren (D-MA) called the dinner “an orgy of corruption” during a press conference, while hundreds of protesters gathered outside the venue.

World Liberty Financial has drawn similar scrutiny, with the Trump family’s WLFI stake swelling their net worth by over $6 billion since trading began. Trump disclosed $57.3 million in earnings in June that lawmakers called “open corruption,” and Sen. Warren labelled a $2 billion UAE investment tied to the project’s stablecoin USD1 “shady.”

Decrypt has reached out to the White House for comment.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.